For most of us, clicking on your browser to surf the web or dabbling around with your smartphone, such a trivial daily thing for us to do. However, it’s often lost on us that those simple activities are your gateway into a complex and fast-changing world.

While your smartphone seems like any normal device used to access Facebook or Instagram, it’s essentially a launching pad to the next digital revolution. Especially now that we’re transitioning from centralized web to decentralized network, the control of individual power is greater than ever.

If you are still new to the centralized vs decentralized, let’s focus on one example that is also one of the biggest technology changes aka Blockchain. This evolution is so disruptive that I believe it triumphs over the internet and smartphone technology combined.

So read on as I try to explain how we as individuals and as a society can not only survive, but also thrive in the next up and coming disruption : The new era of Blockchain.

How We Got Here

Behind the complex digital systems such as the internet and smartphones is one simple concept : to make humans’ lives easier. As technology improves, we are increasingly reliant on it. Still, on certain level we’ll have to learn, or at least understand the systems, to keep up with all these technological changes.

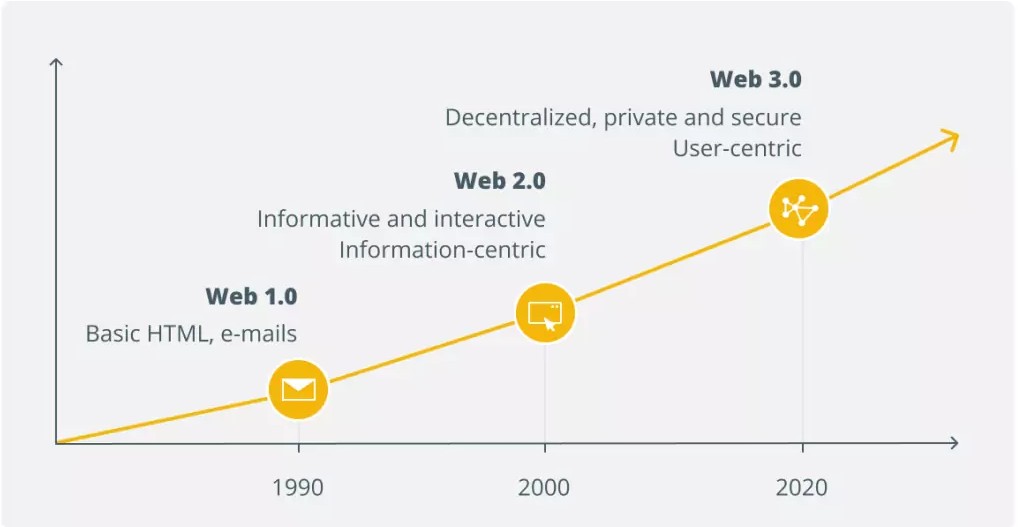

Let’s go back to year 1990 when we were first introduced to the concept of inter-connected network called the internet. For the first time ever, we can use exchange information or send digital documents via email or web server. It was a game changer for many publishers at the time. Albeit pretty static and primitive compared to the next wave of innovation, anyone could begin publishing their own information.

Several years later, Amazon, Apple and Facebook helped propel digital advancements with the birth of applications, gadgets, social platform and more. We can now run a business at a global scale with minimal cost. Web 2.0 has ushered us to the era of globalization, where locations are no longer an issue.

Technology has undoubtedly led us to some of the most prosperous era. It unfortunately has had its share or downside as well. With all of the power now resting on small selected numbers of digital tycoons, economic inequality is higher than ever, climate change, global wars and social instabilities are rising as we speak with no clear end in sight

If you still remember the 2008 housing crisis, a huge meltdown involving large banking institutions, price manipulations and exotic financial instruments leading to the market crash in the US, the impact was massive followed with a long term recession.

Later in early 2010, a group of software developers was determined to come up with a new technology in hope to stop the next crash. How? By shifting the centralized power and taking away the control of certain powerful groups.

Enter the blockchain technology with a mutual goal that allows power to be shared and managed digitally without the need to have any centralized institution. In short, Bitcoin was born.

What is Bitcoin ?

To understand Bitcoin, we must first know the system it was built upon or Blockchain.

Essentially, Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat upon. Unlike Google or Facebook database which is stored into one single system, the blockchain technology is a database that is duplicated and distributed across the entire internet network.

While the system is replicated across millions of computers, the data itself is secured using the latest of the best encryption system. It is virtually impossible to hack, steal or stop the computer systems. This relates to the main purpose of Blockchain which is to eliminate single dependency, by creating many duplicates systems, and build a safe-proof application of tomorrow.

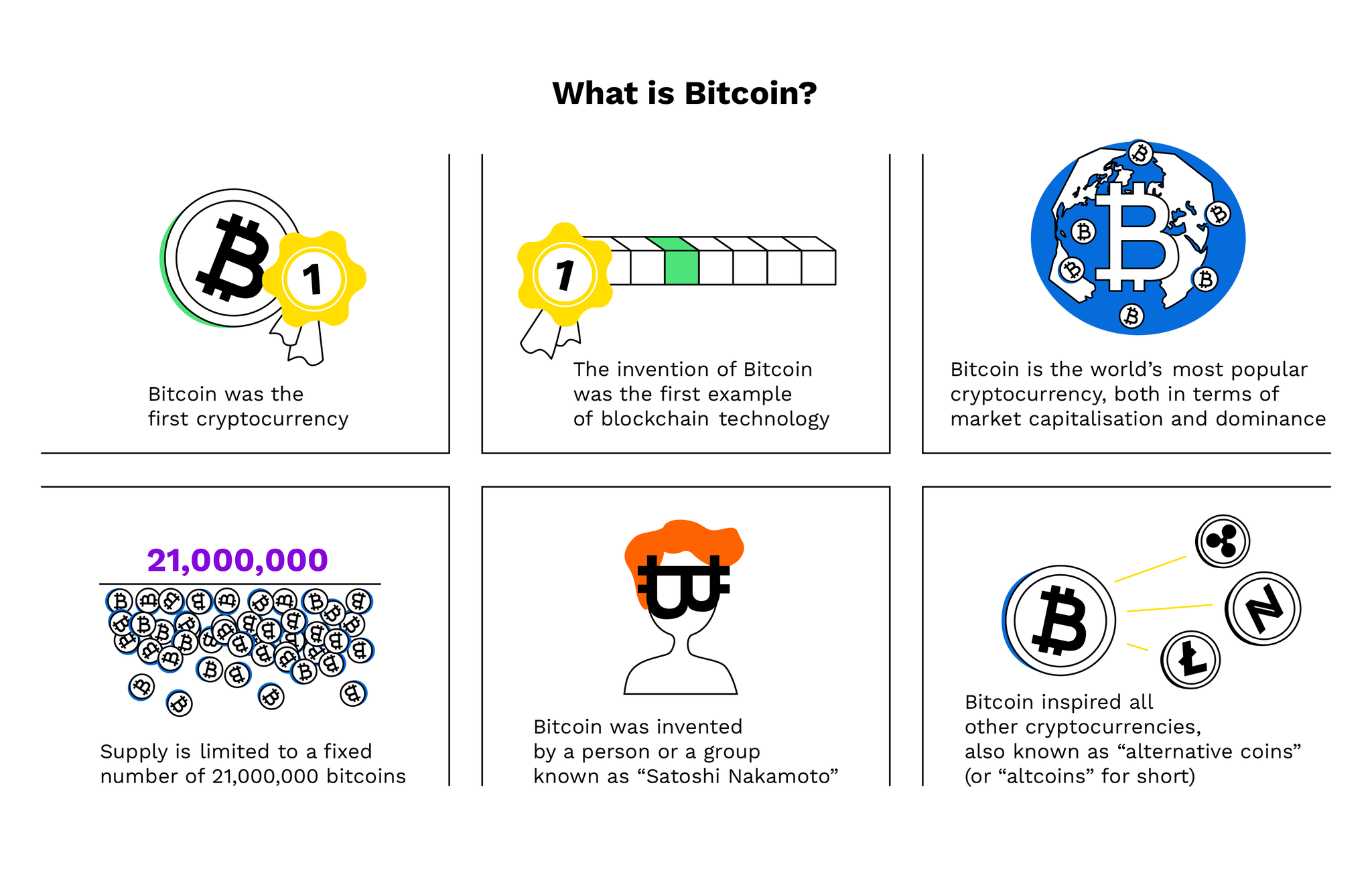

While there are many blockchain types, no one can talk about the it without mentioning Bitcoin (BTC). The reason is because Bitcoin is the first successful implementation of blockchain, making it the world’s 1st cryptocurrency powered by blockchain technology.

Bitcoin was invented in 2008 by Satoshi Nakamoto, whose real identity is still unknown. It is the world’s most popular and globally recognized digital currency, both in terms of market capitalization and dominance.

While the idea seems flawless on the surface, Bitcoin is rejected by many governments and green movement organizations due to its electricity consumption. However, despite all claim about its energy usage, Bitcoin is not wasteful in relative term. Electricity is still an essential component to run the system, secure access and data integrity while keeping the ecosystem decentralized and censorship-free.

Personally, I believe that anything of value is worth the energy usage. Our banking systems need energy, our internet needs energy and no one complain about it. The good thing is that bitcoin energy usage is actually quite flexible, since it is operable in any form of energy, including green energy ( solar and wind power)

The issue with energy consumption mainly is related to the process of how a Bitcoin is created or the mining process. See, Bitcoin is mined in a computer with a super powerful processing and encryption power. Once the process is done, the miner is rewarded with a newly minted Bitcoin.

This process is ongoing and every 4 years, the encryption software automatically works twice harder to generate a new bitcoin. There is a finite mining limit to Bitcoin supply which is a fixed number of 21,000,000 bitcoins.

Why Now Is The Time For Bitcoin

It’s my strong personal belief that everyone should owns Bitcoin. The world has been in endless turmoil and the pandemic Covid-19 has exacerbated the situation drastically. We’ve seen more rising finances problems, struggles in distribution logistics and supply chains, low productivity, and stunted global economy growth.

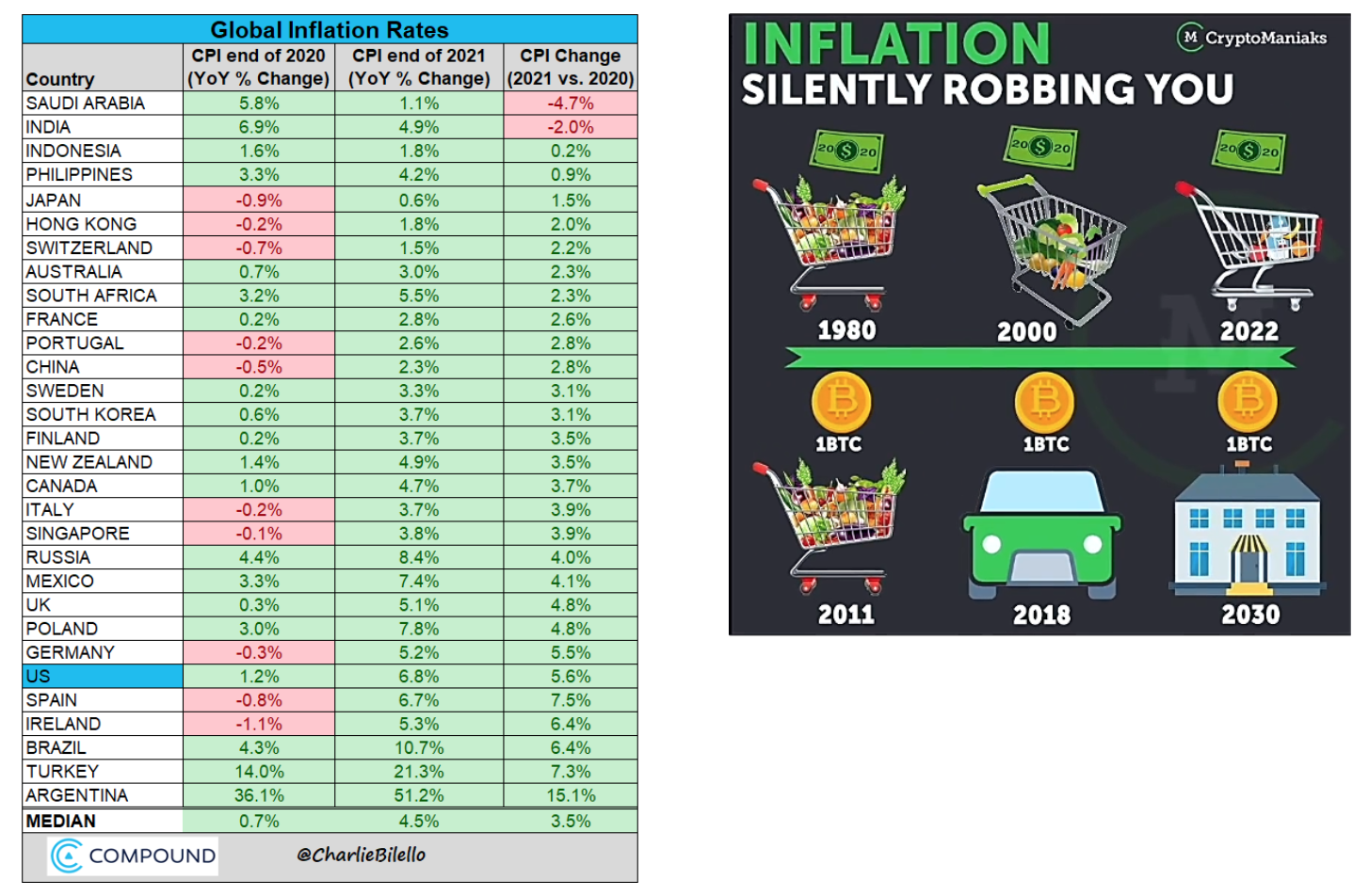

To reinvigorate the market, many governments typically resort to money printing, which leads to inflation. That means lower buying power and rising prices, from the price of a single meal to essentials such as gas. There’s no denying that this is the current path the world is threading on, and it’s pretty much the singular way to do it.

Until Bitcoin comes along that is. Bitcoin can be an excellent means to protect your wealth since it’s insured against inflation. Unlike conventional currency, Bitcoin 1) can’t be manipulated around the idea of inflation by any government 2) continues to rise in value 2) is limited in supply and known ( maximum of twenty one million bitcoins in circulation)

The design of Bitcoin or cryptocurrency is to deflect around the idea of single control, whether it’s the government, certain finance institutions, or other form of dominance. This makes it predictable and secured around inflation. True, Bitcoin also experiences its ups and downs, but as a hedge against inflation, it’s a much safer bet with an increase of over 300% since its inception date).

For the older generations, the idea of Bitcoin may seem too far-fetched and hard to comprehend. But it’s a welcome change by the future generation who is more tech-savvy and digitally native. These are the people who indulge in cashless payment and internet banking as their daily go-to idea.

It is not the end, it is just begin.

Bitcoin is not for everyone. However for those who open minded, it would be a good idea to start looking into it, do your research and make an informed decision. Like any good investments, time is of the essence so the sooner you do it, the better. Think of it as a way to enrich your finance portfolio and a great learning opportunity.

With this article, I hope that it illustrates what Bitcoin is and can serve as an insight somehow. I’ll be sharing more on topics around Bitcoin including how to buy and cash it in my next article, stay tuned!