The Misconception of Risk vs Uncertainty

As I embarked on my journey as a digital nomad, many of my peers viewed my decision as reckless and even crazy. They saw it as a departure from the comfort and security of home into what they perceived as dangerous territories. Sadly, this resulted in the loss of several friendships.

However, it is not their fault. Our brains have been wired over millions of years of evolution to avoid risk and uncertainty. This makes it difficult for our brains to distinguish between what is truly risky and what is simply uncertain.

But what if, with the right knowledge we can understand the difference? Even better, what if we can somehow reduce risks while threading on the fine lines of uncertainties?

Understanding Ellsberg Paradox

When talking about risk or uncertainty, I think we can all agree that we tend to avoid those two. Or at the very least, we prefer to make decisions when there are a certain level of certainties. We try to measure the gather all the available information or measure the known risks before deciding on anything.

Enter The Ellsberg Paradox. Named after economist Daniel Ellsberg, the paradox refers to a situation in which a person’s preferences between 2 options depend on their level of uncertainty about the outcome, even though the options are mathematically equivalent or measurable.

It challenges the idea that people are equally comfortable making decisions with known risks and unknown risks. Take this experiment as an example:

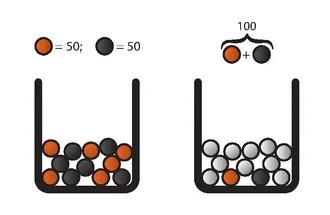

Imagine there are 2 bags : the ‘known’ bag and ‘unknown’ bag.

In the ‘known’ bag, there are 50 red and 50 red balls. Meanwhile, the ‘unknown’ bags contains 100 balls that are red or black in an unknown proportion.

To win, you have to select a bag, name a color then draw the mentioned color.

Now, which bag are gonna be your choice?

When asked this question, most people opt for the ‘known’ bag. On the surface, making the choice that offers a 50/50 chance seems obvious. But when you think about it, the likelihood of drawing a ball in the color of your choice in bag ‘unknown’ could be higher. Even if the reward is higher, many will still prefer to choose the known risks.

This so-called Ellsberg paradox illustrates our initial statement: when asked to choose, we prefer risk over uncertainty, even when mathematically they come up with the same or even better result.

Another illustration that maybe hits closer to our modern live : buying insurance. For example, one policy might cover the risk of a house fire, while the other policy covers the risk of a house fire or theft. In this scenario, a person must decide whether to buy insurance for a known risk (a house fire) or for a known and unknown risk (a house fire or theft).

According to the Ellsberg paradox, people tend to prefer known risks over unknown risks, and therefore, one might expect most people to choose the policy covering the known risk (a house fire). However, this preference may not hold when the person has more information about the risks and their likelihood.

In insurance, it is common for people to seek coverage for the most likely risks, even if the risks are unknown. The Ellsberg paradox highlights the fact that people's preferences for known versus unknown risks are not always consistent, and can change based on their level of information and understanding.

The Known Known vs Unknown Unknown

To dive deeper into risk and uncertainty, let’s first define what risk is.

Risk refers to situations where the probabilities of potential outcomes are known. This information forms the basis for calculating the odds of each outcome, such as when rolling a pair of dice or playing cards. In these cases, we can determine the likelihood of each outcome in advance.

On the other hand, uncertainty refers to situations where the randomness of outcomes cannot be expressed in terms of specific probabilities. This occurs when we do not even know the possible outcomes beforehand.

Frank Knight, in his book "Risk, Uncertainty, and Profit" - (which you can read here) - wrote about the difference between these two types of unknown, differentiating between "risky" and "uncertain" situations. In short, risks are quantifiable, while uncertainty is not.

Risk and Uncertainty

To confuse uncertainty with risk is a foolish act. Why? Let’s discuss:

- We think we know everything

Let’s say, you’re a smoker who is diagnosed with a lung disease. The doctor said that by taking a medicine, there’s a 90% chance of recovery BUT there’s also a 10% chance of it getting worse.

Armed with this information, you will likely feel confident - a little too confident even. You take the medicine, but not stopping smoking. Why should you when there’s a 90% chance of recovery at hands?

We tend to gamble more when we have more data. We act like everything is a known risk and we become more eager to take more risks. In return, we increase the chance of failure by overdoing it.

- We give up since it’s ‘unknowable’ anyway

On the other opposite : we act like everything is uncertain. This is why uncertainty gets a bad rep as the root of inaction.

We believe that once something is identified as uncertain, it is final and cannot be confirmed. In reality, we can take whatever lack of information or uncertainty, and learn from it. If someone had told me that being a digital nomad is risky and that I had believed it, it would stop me from doing my own research or experiencing this journey.

Lest we forget, the price of inaction is severe. The cost of doing nothing can be more severe than doing something and you can’t change my mind about it.

It’s An Uncertain Future

We human hates unknown. We immediately come up with reasons or visualize all the negative outcomes. The positive ones? Not so much. We instantly assume that anything uncertain is automatically risky, and risky is better than uncertain. We fail to see how most of uncertainty is not automatically risky.

Here’s another example : it’s easy for many people to assume that living in the US is safer than living in outside US - say Medellin and Mexico city. We’ve heard a handful of scary stories or at least, one that paints one large swatch of land as a risky place.

Well, I personally have been to both cities and on different occasions found it to be just as safe as in the US. If you want to be logical, there are 8X more crimes committed in total in the United States than Mexico, largely due to America's size and population. America also has higher rates of gun violence, sexual assault, and drug abuse. Although Mexico does have a much higher murder rate (source).

This just goes to show that anything uncertain can still turn out safe. We can increase our chance of safety by spending time researching the subject, gathering reviews or experiencing it ourselves. On the other hand, risky decision is unlikely to be made safe - despite our best efforts in preparations sometimes.

An Uncertain World Can be a Good Thing

Living in world that uncertain is not all bad. Since nothing is set in stone, it can still be a good thing, a great one even. Consider the opportunities or how life volatility can propel you to incredible breakthrough.

Imagine if we live in the world where all outcomes are known. Where is the fun, thrill or the spirit in that? There is no point in even trying at all.

It is an uncertain world we live in, and the best way to live is to embrace it - this I’m certain. We can’t always avoid all risks, that would be impossible. But there are measures we can take, simply by understanding these below:

Understand the difference between risks and uncertainties.

Mitigate known risks, such as insurance!

Invest time in researching and understanding your personal uncertainties.

Taking risk can lead to learning, personal growth and better live.

Profit happens when most people see the opportunity as risky, yet you see it as an uncertainly that is worth taking the risk for.

Still need more convincing? Well, what about this : Research shows that people who enjoy taking risks tend to be more satisfied with their lives.

So if you plan to change your mind about this risky business, you may just have a chance at happiness - and how can one say no to that?