If you are feeling stressed and in constant worry, you are not alone. Ever since March 2020, it is safe to say that most everyone has experienced something they have never seen before. The pandemic is kicking everyone in the butt, and changing everything that we once took for granted.

The future is so uncertain. Nothing is untouched through this event. We are no longer sure what the future looks like. Everyone now works from home, schools and businesses are mostly in lockdown. People are suffering.

People are considering something that was unthinkable one year ago: alternative investing. Bitcoin is becoming mainstream. People are trying to understand what is this new crypto currency, with many of us scared of the changes.

If you found this article looking for a simple answer to "what is blockchain?" here is a quick answer to your question. Blockchain is the technology behind digital currencies like bitcoin. It was designed to revolutionize the way we communicate over the next ten years. It will be bigger than the internet and it will change our lives forever.

If you’re looking for a more in-depth understanding, you are in the right place and I encourage you to continue to read.

1. My Bitcoin Story

Before we get started, let me tell you a story. It was 2017. I was bored out of my mind after working for a large media company on a long, boring eCommerce project. To keep my mind occupied, I got on Reddit and stumbled upon a discussion about bitcoin. My interest had been piqued ever since I read two science fiction novels by the great writer Neal Stephenson—Snow Crash and Cryptonomicon. On Reddit, I realized that bitcoin is the digital money described in these prophetic novels.

When I read Stephenson's books in early 2000, I was totally sucked into learning about the possibility of running a crypto-based economy. It has been almost twenty years since I heard about the concept. After I discovered the bitcoin discussion on Reddit, I spent the next week reading as many books on this subject as I could. I quickly did my research on the web and found that bitcoin has matured to the point that it is usable.

I was intrigued to learn more so I googled "how to get started with bitcoin." The link sent me to the nearby shopping mall with this machine.

2. Advantages of Blockchain: Why You Should Care

What is money? Money is an entry in a database. - Elon Musk (in Wall Street Journal interview)

The Problem with the Centralized Monetary Solution

Right after World War II, experts from all over the world went to the Bretton Woods Conference in New Hampshire to figure out new global financial rules. One of the results of the conference was establishing the US dollar as a global reserve currency, backed by gold. It made a lot of sense at that time, the United States emerged as the victor with all of its factory and production lines in tact, while the rest of the world was in shambles.

But with continuous crisis after crisis, the US government started to be less picky about the standard. Starting in 1971, the dollar was no longer backed by gold—it was just backed by the trust of the people of the United States.

In reality, the US dollar is now backed by armed forces rather than by gold. This shift is profound and it is also indicative of a larger psychological shift in American society. We have become avoidant of doing difficult things for the good of the long-term. Instead, we choose the easy way out, the short-term fix. Every single crisis and financial problem has been powered by greed. Instead of solving the problems, we choose to kick the problems down the line to the next generation.

The US used to be able to point to the gold reserves if ever called upon to prove the credibility of the dollar. What does the US say now, instead? It says, “You know we’re good for it.” It says, “Just trust us.” The reason why America can say that is because America has the largest armed forces, and we scare everyone else. It’s like the mafia, or a bully.

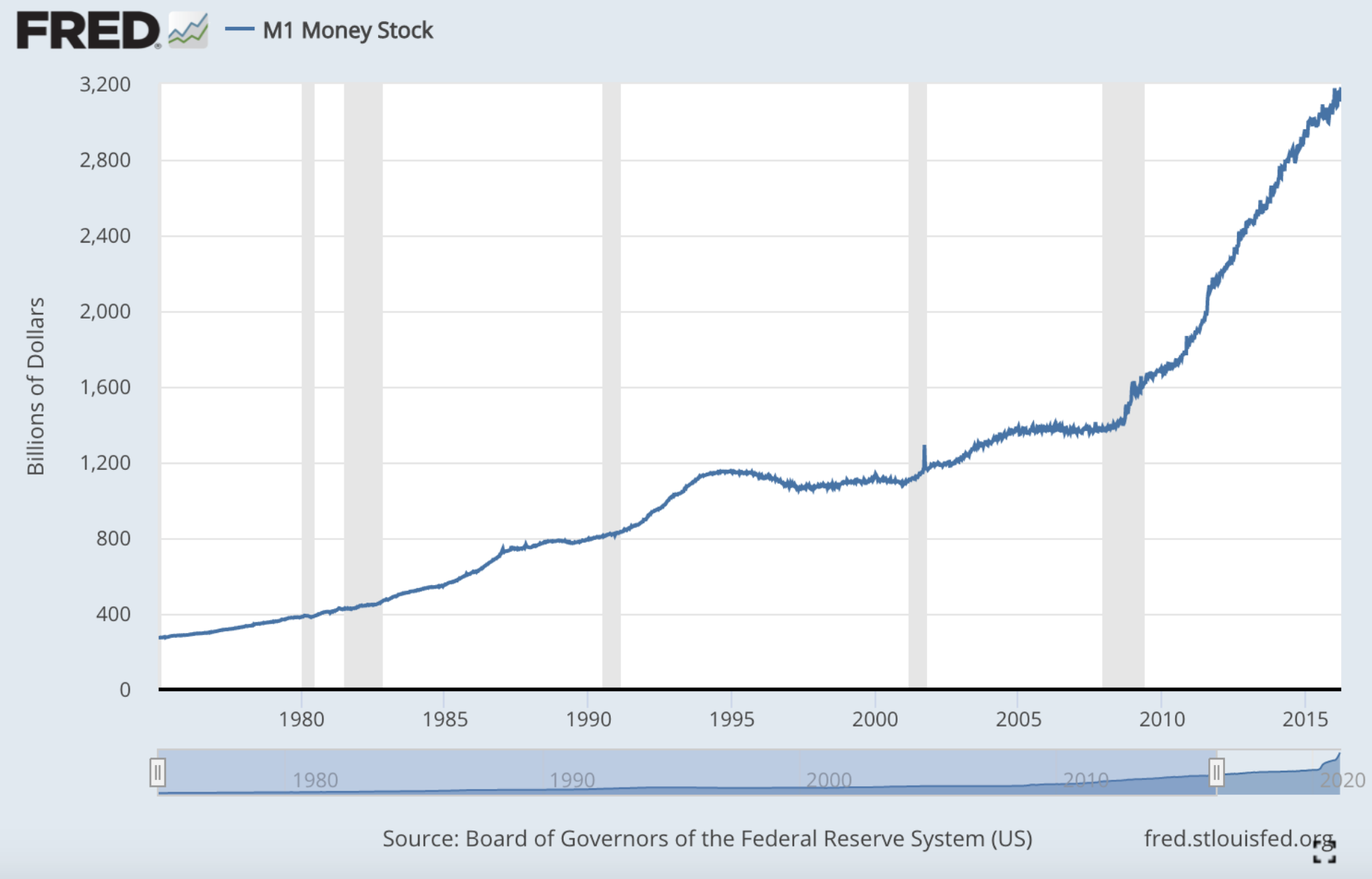

As a result of the pandemic, the US Federal Reserve has had no choice but to devalue the currency to get out of this global problem. They started printing money to help restart the economy. In 2008 and also in 2020, with quantitative easing, the feds went through printing binges to support the economy. In 2020, they did this while the whole country went to lockdown. This is happening not just in the United States, but every single country in the world.

As the money supply continues to skyrocket, the US dollar as a global reserve currency is being challenged by alternative assets such as gold and, more recently, blockchain-powered cryptocurrency. With the power of US dollars managed by a handful of fed governors, it is easy to see the problem of centralized finance. Over time, the system is manipulated and the value deteriorates.

What is Money Anyway?

Let’s back up. Think about what money is for a minute. Your money is a snapshot of transactions that happen to your account that are recorded by the bank. The bank has the last say on how much money you currently have. Think about that.

Now, think about what would happen if your bank account got hacked. You would be responsible for coming up with the proof that these transactions are incorrect. Unfortunately, sometimes this is hard to do. Similarly, if the bank says you owe them $1,000, it doesn’t matter if you actually do or you don’t; the bank says you owe, so you owe.

Those examples are just a few of the problems that we have seen come out of the centralized approach to managing trust and money. Trust, like money, is hard to earn and easy to lose, especially in the hands of the few.

As the world becomes more and more connected and information becomes centralized, so do we see identity theft exploding at an alarming rate. It is increasingly difficult to figure out the truth.

<hr />3. Learn Blockchain and Bitcoin in Detail

a. The History of Blockchain

Bitcoin was born after the 2008 housing financial crash. The history of blockchain and bitcoin are a little bit mysterious. There were many attempts to create digital money before bitcoin. Two of the early pioneers are Nick Szabo and Adam Beck. Szabo pioneered the proof-of-work system used today by bitcoin with his BitGold protocol. BitGold pioneered the concept of a decentralized network that makes peer-to-peer verification systems possible. Cryptographer Adam Beck came up with a way to do a digital signature, called a hash key, to ensure tamper-proof data validation.

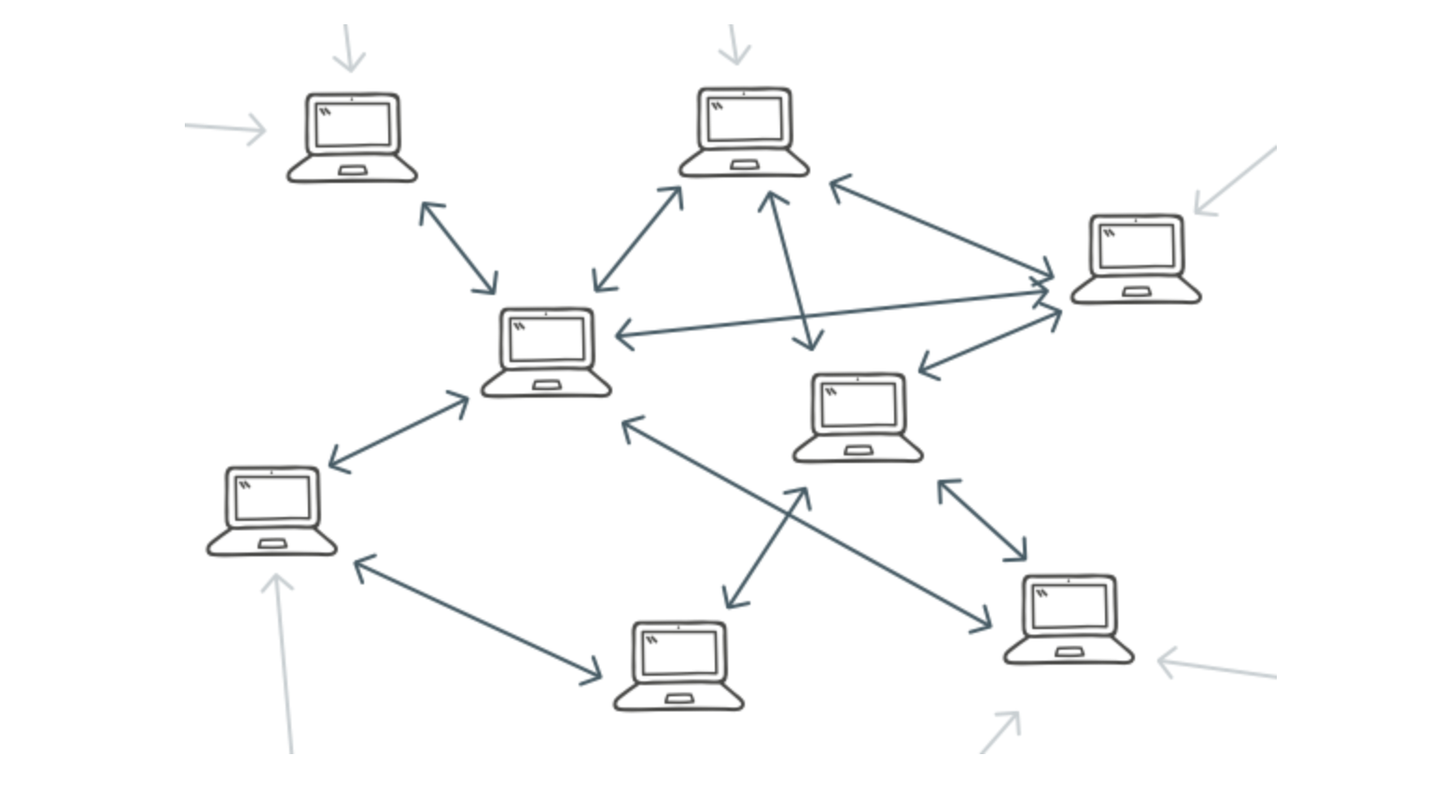

Satoshi Nakamoto is the name of the person or persons (it is most likely a pseudonym) who took these two concepts and added a new technology that we know today as the blockchain. Blockchain takes all of this encrypted data and makes it easy for it to be duplicated across a vast network of computers, with a clever incentive to ensure that the network grows organically. It takes the same concept of BitTorrents and makes it impossible to shut it down.

b. How Blockchain Works ?

To understand how blockchain works, let's break it down into two parts:

the network and

the data.

The blockchain network is a network of peer-to peer-servers that is connected to the internet 24x7, dedicated to running blockchain software. It does not need a centralized server. The software for the server is free for anyone to download and instal. You can find the software in github.com (https://github.com/bitcoin/bitcoin)

Anyone with a computer can participate in the blockchain network. Once the code is installed and the server is up and connected to the internet, it will start to download the data, also known as the ledger. Each server contains an identical copy of the ledger.

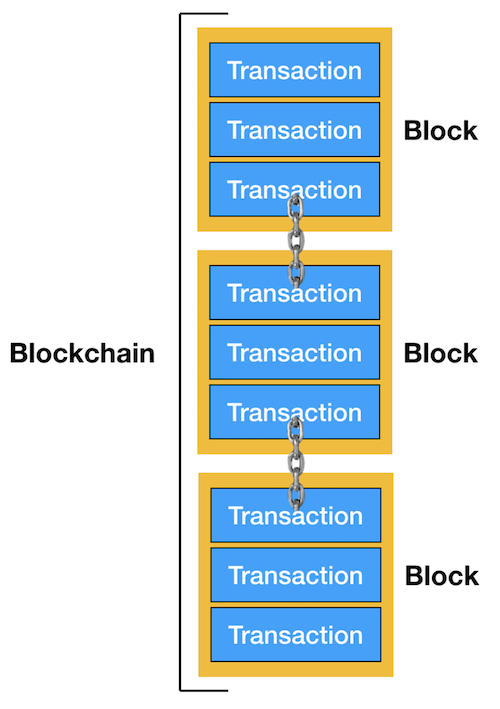

Now, let's talk about the second part of blockchain—the ledger. The ledger is the file that contains all of the transactions since the beginning of the blockchain. These transactions are grouped together into blocks, and each block is chained together using a mathematical algorithm called blockchain.

Whenever you are transferring cryptocurrency, it will create a record of that transaction that gets recorded into the ledger, that also gets copied over millions of servers. This series of blocks creates an audit trail to make sure that every account is correct and can't be manipulated.

<hr />4.Getting Started with Cryptocurrency

When it comes to getting started, which I think that everyone should, it’s important to note that there are two ways to go with cryptocurrency. You can get your own private digital wallet, or you can use what’s called an exchange. Exchange is what the US government wants you to do. It works more like a bank, just instead of storing dollars it stores bitcoin. I recommend the digital wallet route because it is more secure.

Finally, I’m going to throw you a curveball: bitcoin is not the only digital currency available. Anyone can create their own. Right now, however, there are just two big players—bitcoin and ethereum. Because bitcoin was the first to be developed, there are some aspects that haven’t been thought through as much. For one thing, bitcoin is not designed for transactions. Bitcoin is more like gold. If you want to use it for a transaction, you have to chop it up into really, really thin slices. Ethereum is designed for transactions. In that way, ethereum works more like money than like gold. For that reason, I like ethereum better.

Ok, stop talking and take my money already. How can I exchange my dollars to bitcoin? Well, I am glad you asked. There are several ways, here some listed below:

1. Get it the old fashioned way: Bitcoin ATM

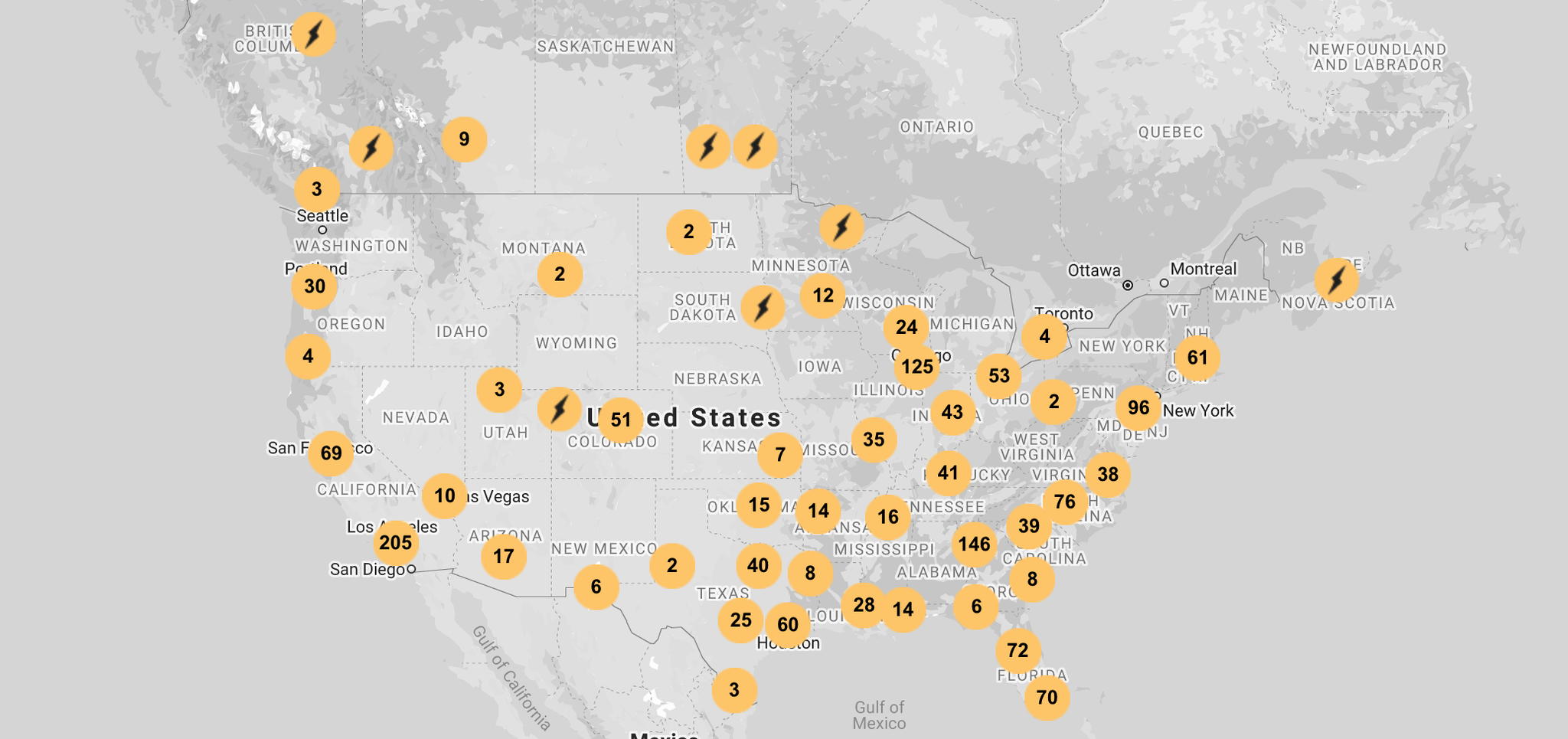

- Go to https://bitcoindepot.com/ to find an ATM near your location.

Bring cash.

It has a limit on how much you can purchase.

It is not the best but it is convenient.

2. Sign up with an exchange

Coinbase is the largest exchange for US based customers. It is the safest and easiest to get started. To get started, all you need to do is link your bank account to coinbase. Once linked, you will need to show a driver's license or passport to sign up. This is to adhere with money laundering laws.

My experience as a customer using this exchange, I found it both convenient and their customer service is excellent.

3. Do it in person

- Exchange in person using Crypto Local

4. Shop with companies that accept bitcoin

Travel without any foreign coin

5. Tools to make you become a Bitcoin Boss

a. Digital Wallet

Your coins are secure using Private Key Infrastructure-based cryptography. It was based on 128-bit encryption, which is virtually unbreakable using today's technology.

Every single coin needs to reside in a virtual wallet. Each wallet has a pair of private and public keys. Think of public key as your home address, and the private key as the key to your home. While you can publish your home address, you don't want to publish your key to your home.

When you buy or sell your bitcoin, all you need is the destination wallet. You can even send the funds via email and they will be safe.

Like a bank, sometimes you don't want to store all your cash at your home. This is why you can use an Exchange to store your coin. This strategy is not recommended, since it suffers from the same problems as dealing with regular banks. The exchange gets hacked or, even worse, managed by a bad party. It, however, provides a good way for in someone who is technically inclined.

b. Apps for Managing Crypto

Now, once you have your first coin, you will need to manage it. Here is a list of apps that can help you track and manage your portfolio.

1. Portfolio Manager

Delta App to manage your portfolio

You will need this for tax purposes

2. Exchange and Coin Listing

Coinbase.com exchange

OKCoin for AltCoin

A good place to learn and purchase coins.

3. Make your coin work harder

- Compound.finance and Celsius.network allows you to loan your bitcoin to others

Final Thoughts

Addressing the fear, uncertainty and doubt

Blockchain and cryptocurrency are both new, radical concepts of money. As with everything else, eventually everything will be transformed to a digital format. We started mail and created digital mail, from brochures to faxes, from stores to eCommerce, and from reality to virtual reality.

As with everything new, there is a lot of unknown with tons of risks. The same thing happens with bitcoin. It went through a lot of volatility in the early years, but it is still here and getting traction. The value of it has consistently doubled every year for twelve years, since it's humble beginning in late 2008. It has weathered many legal challenges, coordinated hacking, and many more false starts. In short, I think bitcoin is here to stay. It is steadily becoming the most dominant vehicle to fight against the rapid inflation which is going to happen and, in fact, is already happening—we are already seeing governments printing more and more money.

The more chaotic the world gets, the more printing of money is done by the governments of the world. But my belief is that the way to survive in the future is to adopt an antifragile mindset, where the more chaos the world sees, the stronger the world gets.

Cryptocurrency is the only antifragile asset I can see. It is not losing its value. It is gaining value. It can be used all over the world, and sent anywhere in the world in ten seconds. It can mean a more united world, with one currency for all.

Fear conquered is strength acquired

Bitcoin, for me personally, is a symbol of hope. With never-ending chaos that we see on a daily basis, it can grant you freedom to be you. Freedom to be able to travel and work anywhere, to send money anywhere without paying exorbitant fees. Freedom from dead end jobs by using passive income generated by using bitcoin as assets. Protection from inflation. A safe asset.

We are still early in the new bitcoin economy. It is not too late to get started, to start becoming more antifragile. My advice is that, at the very least, everybody should get their own digital wallet and buy $100 of bitcoin, or even just ten or twenty bucks to start. Do your own research, play with it, and experiment. Make your own mind up about whether this is for you or not, but do give it a try.